How to Save Money on Travel

I personally love to take as many trips in a year as possible, meaning I need to stretch my travel budget as far as I can. So, over the years, I’ve discovered a few hacks & tips for how to save money on travel and I figured I’d pass my info along! Be sure to share this guide with your friends & family, so they can travel more too!

AAA Travel

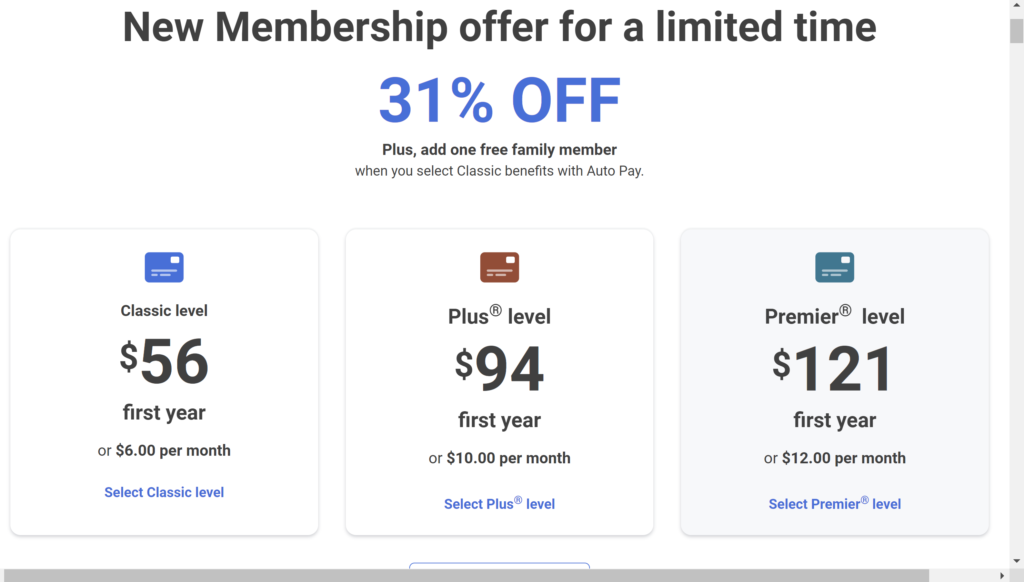

Many people don’t know this exists, but AAA (yes, the roadside assistance company!) has an entire travel platform, where you have access to discounts on SO many travel components. You do need a membership with AAA to book travel through them, but their memberships are very affordable. The basic plan starts at $56 per year ($6 per month) and this basic plan gets you access to both the roadside assistance perks AND the travel perks! You can also typically find discounts on the membership price by being military personnel, a teacher, etc. Visit their website for a breakdown of pricing, perks, and more.

What AAA Travel Offers

- Access to AAA travel agents to help with trip planning

- Discounts on countless travel components including flights, rental cars, cruises, hotels, excursions, theme park passes, tickets to events (sports events, concerts, etc), + more!

- Access to pre-planned, group trips (similar to Contiki or Ultimate Break) – a trip where you go with a group of people you don’t know & most of the itinerary, including accomodations, meals, etc is planned out before arrival

- 10% off expedited passport services

- International Driver’s Permits

- Travel insurance through Allianz

- Discounted airport parking

- + more! Be sure to browse their travel website to see all that they offer.

Tips for Booking with AAA Travel

- Rental Car Tips:

- I’ve had amazing luck booking rental cars through AAA. Their customer service is helpful and saved me when my flight was really delayed.

- They offer a FREE additional driver when booking a rental car through their platform. Normally, if you’re traveling with someone and want to split up the driving, you have to pay an additional daily fee to include both drivers on the rental agreement. With AAA, the additional driver is at no extra cost, which can save you a lot in the long run!

- AAA has a direct partnership with Hertz, which is where you’ll find their best discounts. When searching on their platform they will also show you options to rent through newer companies like Dollar or Thrifty – from my own personal experience, stick with Hertz!

- While the prices with Dollar or Thrifty might be even lower (& tempting), Hertz is safer all around. When my flight was delayed, smaller companies like Dollar & Thrifty were closed. Most people who booked through them were out of a car for the night.

- Make sure to bring your AAA membership card with you when you travel!

- This is huge, because any component booked through AAA will require proof of membership. For example, if you booked a rental car through AAA, when you show up to retrieve the rental, they will ask for your membership card. If you don’t have the card, they will charge you a rate without the AAA discount, which could cost a lot more than you were expecting.

- Hotel Booking Tips:

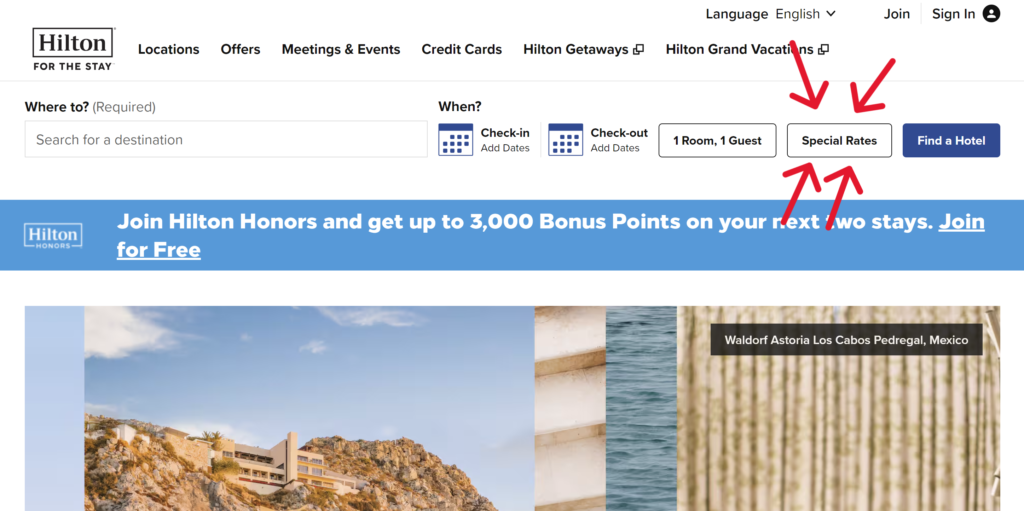

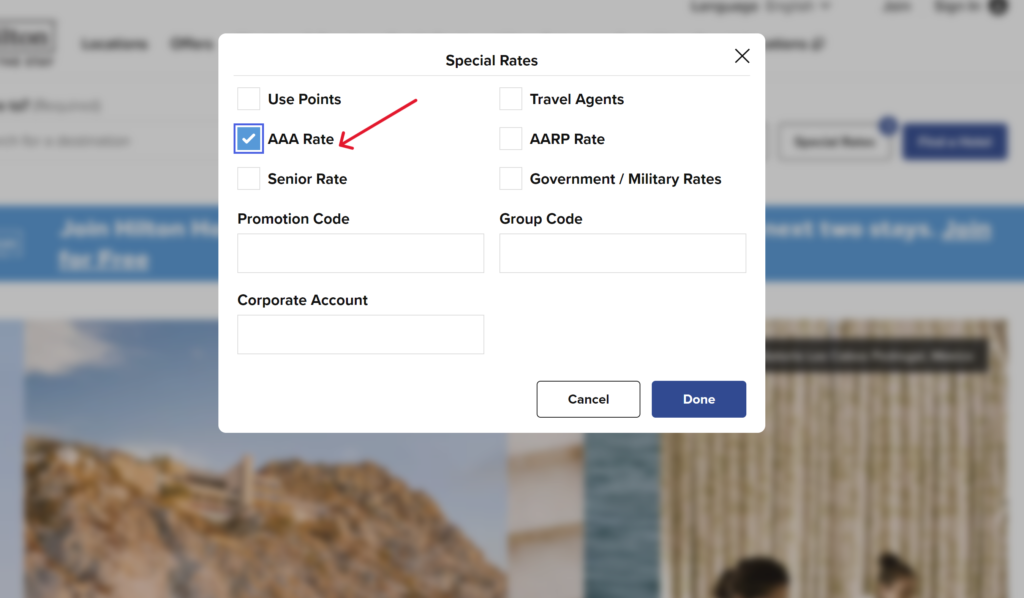

- I personally find AAA’s hotel booking site to be overloaded, and I find it easier to book directly through a hotel’s website using the hotel’s specific AAA discount. On the hotel site, you’ll select “AAA” under the drop down that should say something similar to “Special Promotions” or “Best Rate Available.”

- Busy Bee Tip: The hotel’s nowadays sometimes offer better rates without the AAA discount, so I typically make sure to check the nightly rate with and without the AAA option selected, to make sure I’m getting the best price.

- I personally find AAA’s hotel booking site to be overloaded, and I find it easier to book directly through a hotel’s website using the hotel’s specific AAA discount. On the hotel site, you’ll select “AAA” under the drop down that should say something similar to “Special Promotions” or “Best Rate Available.”

Costco Travel

Booking through Costco Travel is very similar to AAA. Costco has an online platform with access to deals on so many different parts of traveling including hotels, rental cars, theme parks, pre-planned trips, and more. I highly recommend searching through both AAA and Costco when planning a trip to see which site has the best rates at the time.

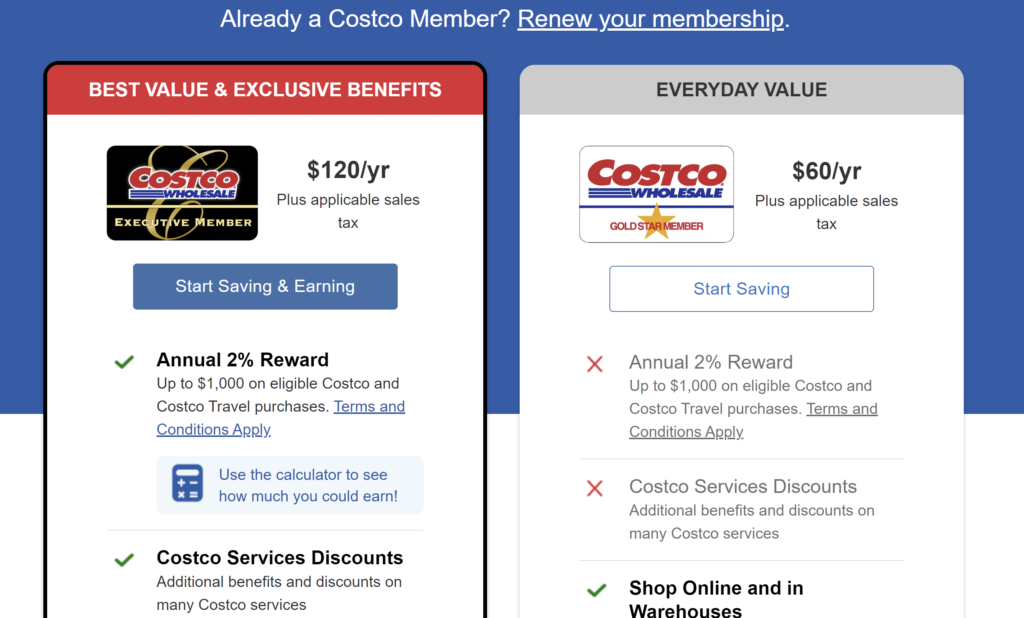

You will need a Costco Membership, but these are pretty affordable as well, for what you get. Their basic plan is $60 / year and gives you access to their grocery stores, gas stations, tire centers, online travel platform, and more.

Tips for Booking with Costco Travel

- Make sure to bring your Costco membership card with you when you travel!

- Just like I mentioned with AAA, any component booked through Costco will require proof of membership. If you don’t have the card with you, they will charge you a rate without the Costco discount, which could cost a lot more than you were expecting.

- Busy Bee Tip: Download the Costco App, which gives you access to an electronic Costco card!

- Busy Bee Tip: Since Costco & AAA are similar platforms, I typically check both sites for whatever I’m needing to book. Sometimes Costco has better rates & sometimes AAA has better rates. So try to hope between both for the best deals!

Credit Cards

Using credit cards as a way to help save money on travel is multifaceted. It goes way beyond just the ability to buy now & pay it off over time. You can earn cash back or bonus miles to pay for parts of your trip, get certain perks and upgrades through your credit card, and more!

Travel Credit Card Perks

Having a specific travel credit card can help you earn things like free upgrades on rental cars, free upgrades on flight status, free baggage on flights, free TSA Precheck or Global Entry, free Door Dash, and all kinds of other perks. Each card is a little different in what they offer, so be sure to do a comparison of 5-6 different ones before selecting a card. You’ll also want to consider each card’s bonus offers & cash back/mile earnings, but more on that later in the post.

- Busy Bee Tip: A lot of cards now a days, also offer travel insurance, rental car insurance, and more. This is definitely something to read into with whatever particular card you choose, but this could save you from needing to purchase separate travel insurance as well!

Everyday Spending on Credit Cards

This tip goes beyond saving money on travel. This is a major life hack in my opinion, that more people should take advantage of! Basically, you’ll want to put every single purchase throughout your daily life on your credit card. Whether it’s a few dollars at the store or a larger appliance purchase, put it on your credit card. You’ll just want to make sure you are responsible and don’t go crazy with spending. You also definitely want to pay off the balance frequently and don’t carry a balance month to month. For some people paying it off every week works, for us, we do every 2 weeks. This way you will rack up cash back or mileage points, just by spending money as you normally would. You can use those cash back or mileage points to help pay for major life purchases like travel!

- Busy Bee Tip: We have done this for years – I couldn’t even tell you the last time I touched my debit card. We usually earn hundreds, or even thousands, in cash back by the end of the year.

- Busy Bee Tip: Spending like this, as long as you’re responsible and don’t carry a balance, can also help you build your credit up.

- Busy Bee Tip: This is also a great tip for when you are on a trip – put all your purchases on a credit card for safety. IF your card happens to get hacked on a trip, if you used a credit card, they can’t drain all the money from your bank account, like they could with a debit card. They could make fraud purchases, but that is MUCH easier to handle than someone taking all the money from your checking account.

Opening a New Card for Points

This tip can throw some people off at first, but opening a new credit card before a big trip can be a huge help with costs. Most credit cards, especially travel cards, offer new customer bonuses in the form of cash back or mileage points for signing up and using their card. There are people that do this frequently and travel full-time. This is called “travel hacking,” which I’m not an expert in. But I do open new credit cards maybe once or twice a year to help pay for bigger trips. So I have some great info and tips on how you can do this too!

How it works

Basically, the bonus points are incentive to get customers to use the new credit card. Typically you’ll have to reach a minimum spending amount in a certain amount of months to be eligible for said bonus points. I’ve seen cards require you to spend $2000 in 3 months, $4000 in 4 months, etc. It varies by the bank and amount of bonus points offered.

The way you use your bonus points also varies by card, but most of them allow you to use them in multiple ways. You can typically use them as a statement credit to pay off your purchases, transfer them to travel partners (airlines, etc) to make purchases using points, or shop through the bank’s travel portal and use your points to pay for things.

Credit Card Tips

- Don’t close the card too soon! Closing a credit card too soon can actually hurt your credit a lot. Even if you use it for your trip, pay it off, and never touch it again, just don’t close it. Do make sure if there’s an annual fee, you pay that every year though.

- Open the card before buying major components of your travel like flights, etc. Most cards have certain spending requirements you’ll have to meet, before earning the bonus points. Sometimes it’s a minimum spending of $2000 in 3 months, or something similar. So my tip is, open it right before booking your flights and trip details. You can put all the trip purchases on the card to help you reach that minimum spending amount quicker, and earn those bonus points.

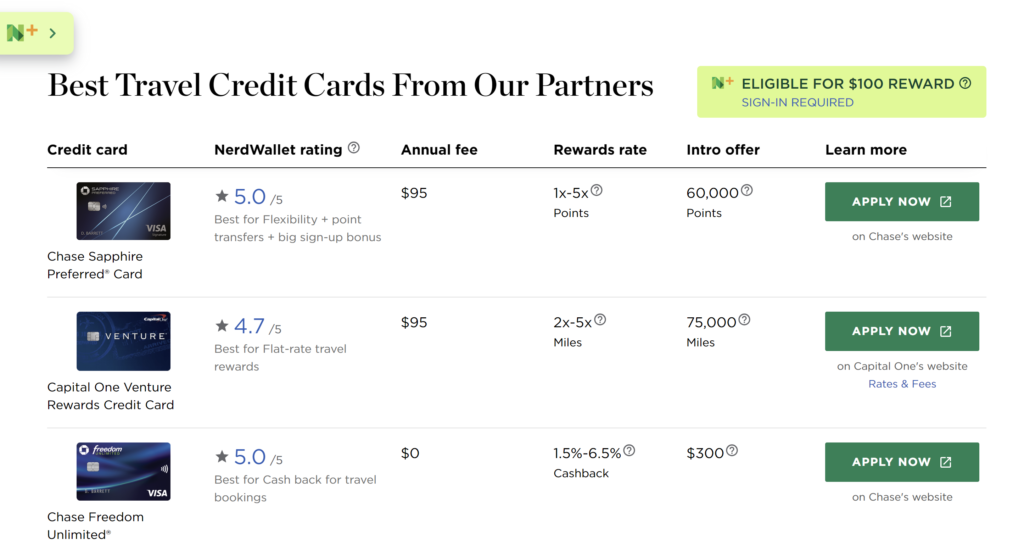

- Use Nerdwallet to compare popular credit cards. To easily see a list and comparison of the top travel credit cards, I always recommend NerdWallet. They do an awesome job writing out the pros and cons of each card, what the bonus offers and earnings are, what the annual fees are, and more. I’ve been using their website for years to select which credit card I open. Nerdwallet does a great job listing the pros, cons, reward points, and perks of each card. (Nerdwallet does NOT know who I am, I just really like their website!)

Busy Bee Tip: We have the US Bank Altitude Connect Card & the Capital One Venture Card. We have had great use for both, but the perks, upgrades, and discounts are better with the Capital One Venture.

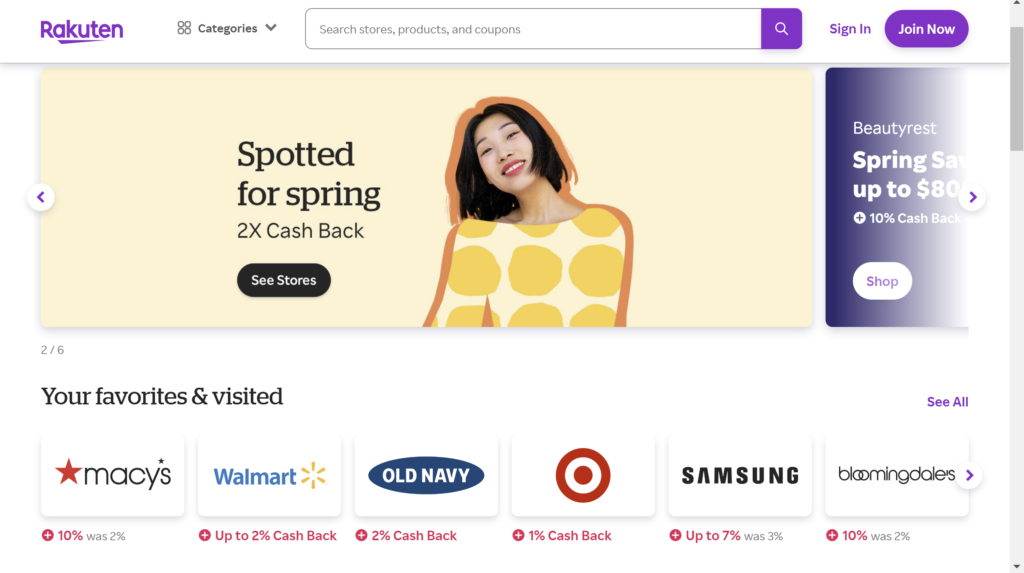

Rakuten

Rakuten is an online, cashback platform. They earn a commision from large brands by referring you (the customer) to their sites. If you want to shop at popular online stores (Sephora, Nike, and many more), try shopping through Rakuten. By going through Rakuten you’ll earn a percentage of your purchase back as cashback. You’ll want to go to Rakuten’s site, search for the store you want to shop, and it’ll direct you to that website. From there, you will shop and check out like normal. The cashback usually takes a few days to update, but should be in your Rakuten account 5 days later or less.

If you’re new to Rakuten, use my referral code to earn an extra 10% back on your first purchase!

- Busy Bee Tip: You can also add Rakuten to your browser so you never miss cashback opportunities when online shopping. They also have an app if you prefer to shop on your phone!

Searching for Discounts

A lot of companies offer various discounts that you might need to ask or search for. If any of the common ones apply to you, it never hurts to ask when booking, if they offer a discount for you. The worst they can say is no!

Some common discounts I’ve seen: healthcare workers, disabled persons, military/veterans, senior citizens, students, first responders, and teachers.

Even the US National Parks offer discounts on their annual passes for various people (including 4th grade students)!

Being Flexible with Travel Times

Shoulder Seasons

This tip I feel like might be a bit more obvious, but being flexible with when you travel can save you a lot. Try to avoid popular travel times like Christmas break, Spring break, and July-August when schools are out for the summer. Try to travel in the shoulder seasons and you can save money and deal with less crowds at your destination! For example, if the destination you want to visit says the most popular time to visit is June-August, try to go in May or September.

Time of Day / Week

What time of day & what day of the week, also affects how much you pay for your travel expenses. This is also maybe obvious, but try to take those early AM flights or late PM flights, because they’re almost always cheaper.

Also try to travel during the week, as opposed to weekends. That being said, on occasion, Saturday flights can be very affordable! The weekday rule mainly applies to major tourist areas, like Disney World hotels or Vegas hotels, etc. They have rates that are sometimes 2-3 times the price on the weekends, when compared with the weekday rates.

Travel Overnight

Travelling overnight when possible is a great way to save money by not paying for an accomodation that night. If you need to take a train, plane, bus ride, etc that is several hours long, try to book it overnight. You can sleep during your travels and avoid paying for a hotel for that particular night. Just bring your comfy clothes & noise cancelling headphones!